Meet the team

The Liontrust Global Innovation Team is co-led by Storm Uru and Clare Pleydell-Bouverie, with support from fund manager James O’Connor. Storm founded the Global Innovation investment process in 2017 and, together with Clare, drives a rigorous and collaborative approach to portfolio management.

Storm Uru

Storm is the co-head of the Global Innovation team. Prior to Liontrust, Storm worked as a fund manager at Neptune Investment Management, running global funds. He holds an BBS in finance and MBS in international business from

Clare Pleydell-Bouverie

Clare is co-head of the Global Innovation team, having joined in 2022. She previously worked in global equities at Neptune Investment Management and in private equity research across a variety of industries.

James O'Connor

James is a fund manager in the Global Innovation team, having joined in 2023 following previous roles in global equities at Neptune Investment Management and Liontrust. James holds an MSc in education research from Oxford University and the equivalent of

The team combines deep global equity experience with a shared passion for innovation, working together to ensure each investment reflects the team’s high-calibre, innovation-led strategy and meets its exacting standards. The result is a dynamic team culture that emphasises research-driven insights and aims to deliver long-term value for investors.

Why Innovation

Academic research shows that companies that prioritise innovation consistently outperform their peers. The team puts this into practice by identifying businesses that are either driving down prices for customers or enhancing the quality-to-price ratio – such as Netflix (creating new markets, disrupting incumbents) and L’Oréal (extending market leadership through sustaining innovation).

Clayton Christensen’s The Innovator’s Dilemma illustrates how disruptive innovators outmanoeuvre incumbents by finding more effective ways to meet customer needs.

By focusing on global innovators, the team invests in companies leading market evolution. Their ability to uncover new revenue streams, sustain competitive advantages, and adapt under pressure supports resilient earnings and long-term growth – making innovation a powerful driver of durable income and capital appreciation.

Figure 1 Source: K Hou, P Hsu, S Wang, A Watanabe and Y Xu (2021) “Corporate R&D and Stock Returns: International Evidence”, Journal of Financial and Quantitative Analysis. Based on 418,067 firm-year observations in 21 countries, July 1981 to June 2018. Quintiles globally pooled, value-weighted and rebalanced annually at end-June. **1981-1987: MSCI World, 1987-2018: MSCI All Country World.

The Global Innovation Approach

The team seeks to generate strong returns by investing in innovative companies. They believe that innovation is the single most important driver of stock returns, underpinned by three pillars:

- Innovative companies deliver superior operational performance and shareholder returns over the long run.

- Innovation is much more than technology and is the key to success in every sector.

- Innovation is complementary to the traditional investment styles of value and quality, and a key part of an investment portfolio in the 21st century.

The Innovation Curve

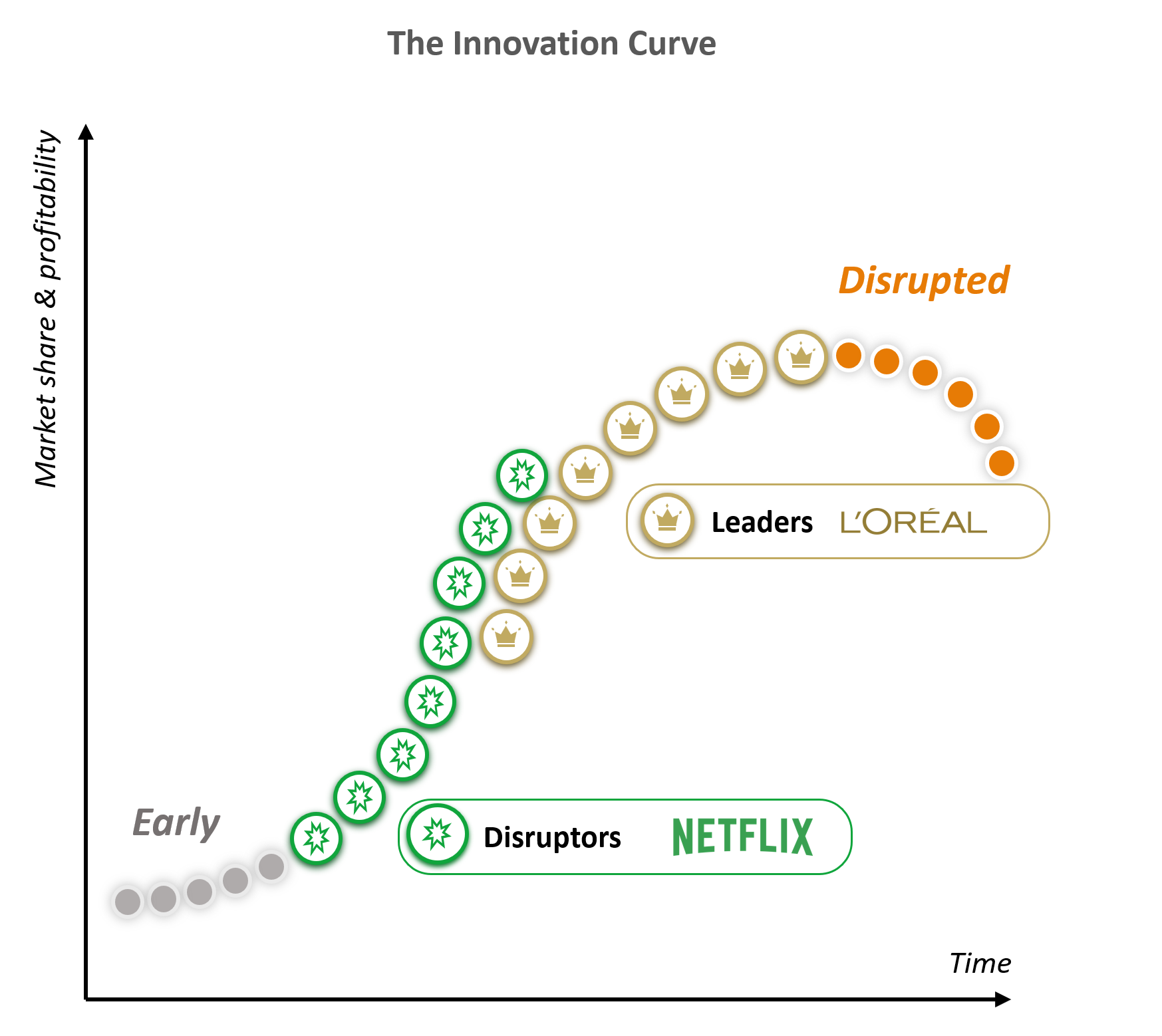

The team visualise a company's journey on an "Innovation Curve" that tracks its progression from disruptor to global leader – and potentially into decline if it fails to keep innovating.

Successful companies typically increase their market share and profitability through continuous innovation, while laggards risk being disrupted themselves.

- The Liontrust Global Dividend Fund targets Leaders (gold section) – best-in-class companies that innovate continually to protect and grow dividends and capital.

- The Liontrust Global Innovation Fund focuses on Disruptors (green section) – companies with major growth opportunities that strengthen competitive barriers while delivering strong returns.

- The Liontrust Global Technology Fund combines Leaders and Disruptors in the technology sector for exposure to the most innovative tech companies and high returns.

The team avoids companies that have stopped innovating (orange section) and those without proven track records (grey section).

Investment Process

The team believes that enduring long-term value is created when innovation meets quality: companies that not only invent or disrupt, but also protect, scale, and convert their ideas into lasting returns.

The investment process follows four key stages:

1. Define the investible universe

The team begins by filtering for listed companies with market capitalisation above $1 billion and the financial strength to innovate.

2. Build and maintain the Global Innovation 200 Watchlist

From this universe, the team maintains a watchlist of ~200 companies globally. Each company must demonstrate four core attributes:

- Innovation (value-creating change for customers)

- Barriers (defensible advantages against competition)

- Management (vision and proven execution)

- Cash returns on capital (ability to convert investment into profit)

3. Valuation and risk assessment

The team applies long-term discounted cash flow models, requiring a hurdle of ~15% annual compound return. Risks – including financial, operational, innovation-specific and ESG – are fully assessed before investing.

4. Portfolio construction & ongoing monitoring

Positions are sized by valuation upside and contribution to diversification. The team actively engages with management, tracks fundamentals, and typically holds investments for three to five years. Sell decisions are triggered by reaching price targets, stronger opportunities on the watchlist, or deteriorating fundamentals.