The perils of using one convenient number as an all-encompassing measure of sustainability.

It is great that sustainability-related criteria are increasingly being used to make investment decisions and sustainability metrics are being more commonly applied to report to clients. We accept, however, that this is an evolving area and is a source of confusion.

Inevitably, because investment teams often don’t have the skills or resources to analyse these aspects of a business, the source of much of the metrics used comes from third party ESG data providers. There have also been a raft of regulation and disclosure requirements for funds making any sustainable claims to prove them with data.

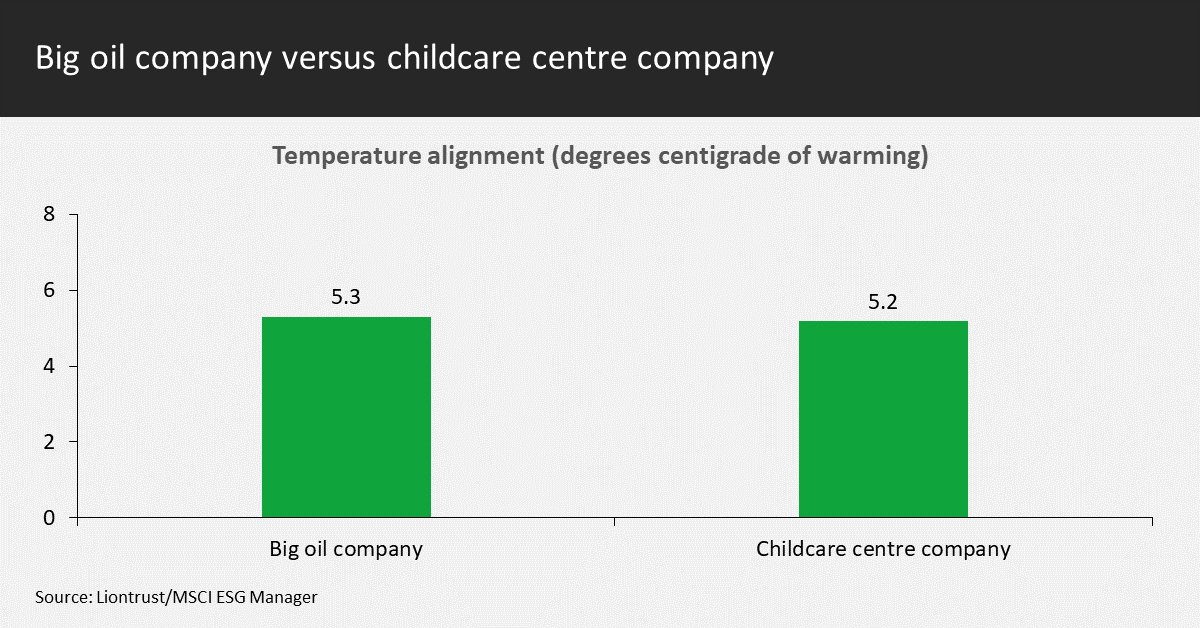

What we have seen, which we think is an error, are attempts at measuring how sustainable a fund or company is using only one metric. We feel this can be very misleading and can result in perverse outcomes in which capital is allocated to areas of the market that are not sustainable. We advocate the use of a few metrics that better reflect the more nuanced nature of sustainability and help direct capital to more proactive areas.

Let us consider two increasingly adopted examples where it is particularly unhelpful to use only one metric to measure how sustainable a fund (or company) is.

Sustainability ratings

Temperature alignment

Source: Liontrust/MSCI ESG Manager

Summary

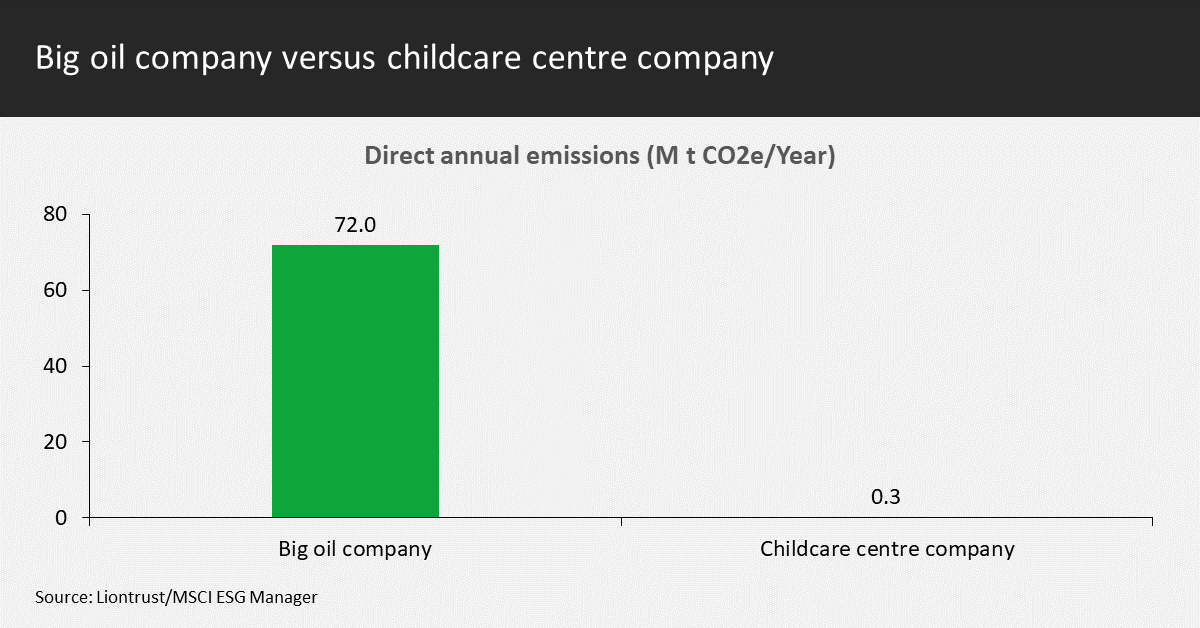

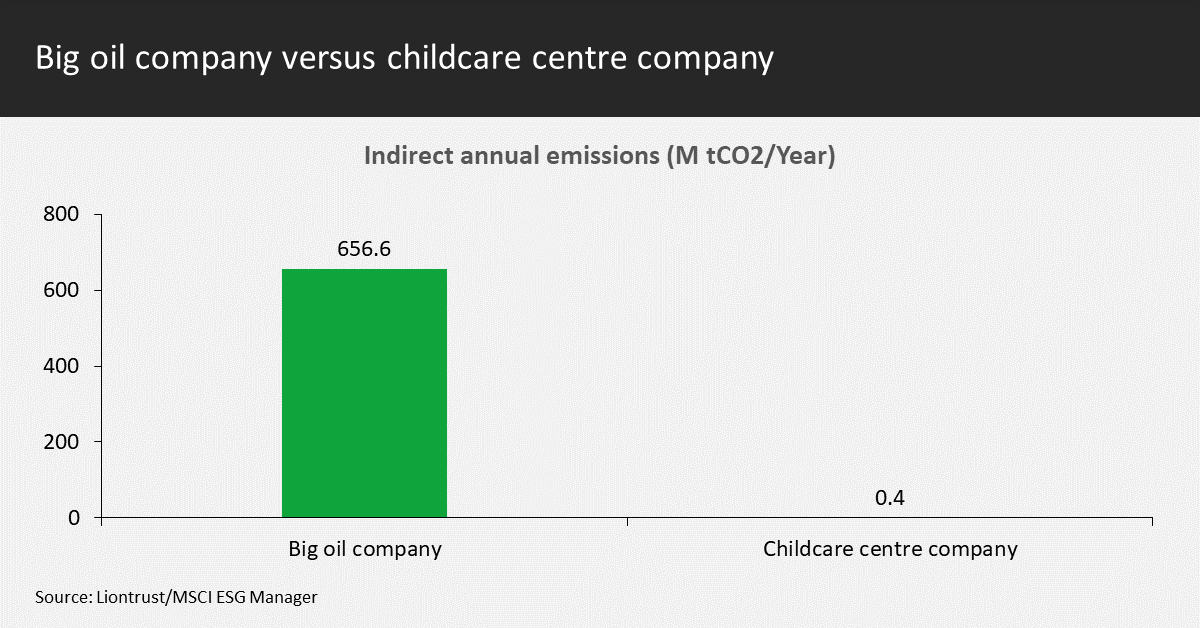

- The big oil company emits orders of magnitude of more direct and indirect emissions compared to the childcare company. Direct emissions are 225 times higher for the big oil company and indirect emissions1 are more than 1,000 times higher, amounting to a whopping 657 million tonnes of CO2e per year. To put this in perspective, this is 55% more than total UK emissions (excluding imports and airlines), estimated to be 424 million tonnes in 20212.

- The big oil company is much larger than the childcare company, but even correcting for this size difference and using a carbon intensity of sales number, the big oil company emits 8.5x more direct emissions for every unit of sales.

- And yet they have very similar temperature alignment metrics of 5.3 degrees warming for the big oil company and 5.2 degrees warming potential for the childcare company. This assumes the companies meet any decarbonisation commitments they have made.

- Incidentally, both these companies achieve the second highest ESG rating from the external ESG data provider. Our analysis draws very different scores for how sustainable these two businesses are.

- How much does the company emit now, and therefore how likely is it that the company will meet this Paris Aligned rate of decarbonisation?

- Are there other lower carbon alternatives to this businesses’ products and services (what is the risk of major disruption)?

- How credible is their strategy to decarbonise?

Original fundamental sustainability research vs outsourcing

What’s the answer?

- Exposure to positive trends from the core business of companies, as well as;

- Carbon foot printing that captures what businesses emit today, and also;

- The quality of engagement and how demanding investment teams are being of companies (are they being progressive in agitating for the quicker pace of change we all need or are they reactive and essentially happy with business-nearly-as-usual).

[1] Estimating indirect (scope 3) emissions is still in it’s infancy, but the quantum is what we are trying to highlight in this example.

[2] UK Government, BEIS 31-Mar-2022, https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1064923/2021-provisional-emissions-statistics-report.pdf - accessed 25-Oct-2022

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds managed by the Sustainable Future team involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. Investment in Funds managed by the Sustainable Future team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Some Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.