A group of barren, uninhabited volcanic islands near Antarctica – the Heard and McDonald Islands – both covered in glaciers and home only to penguins, had a 10% tariff on goods imposed on them yesterday by Trump’s executive order. This, despite no human visitors in nearly 10 years…so goes the US’s new tariff agenda.

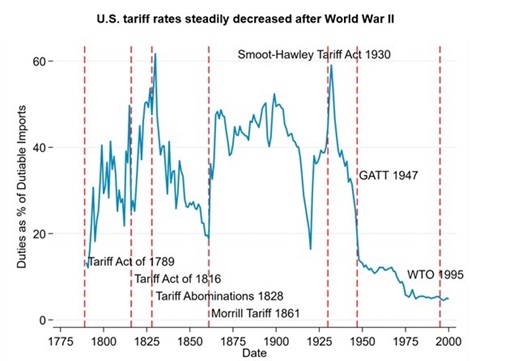

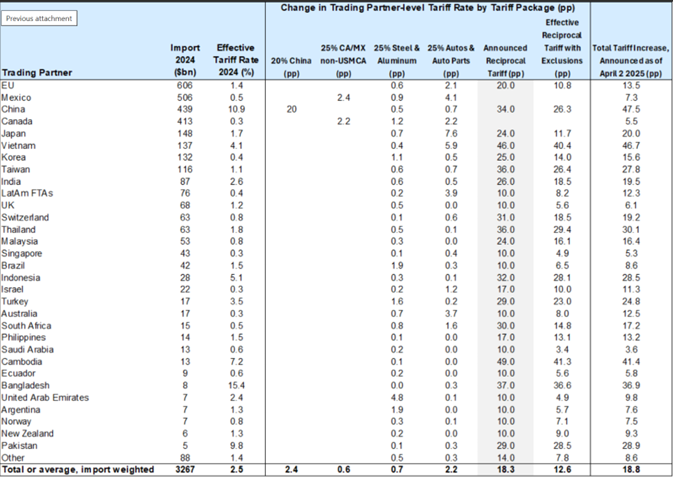

The “reciprocal” tariff policy announced was unprecedented in recent history and imposes a weighted average tariff rate of 18.3%, raising the effective tariff rate to levels not seen since the pre-war period when the Smoot-Hawley Tariff Act was introduced. A reminder that Smoot-Hawley is often cited as a major trigger for the ensuing Great Depression (see chart below), which was only relieved by the onset of the Second World War.

Source: Bloomberg, April 2025

Given that only roughly one-third of total imports would be exempt, this reduces the tariff impact to a 12.6 percentage point increase in the effective tariff rate. While negotiations with trading partners could well lead to somewhat lower “reciprocal” rates than announced today, the prospect for escalation following retaliatory tariffs and a high probability of further sectoral tariffs suggests a risk that the US effective tariff rate rises further.

Source: Goldman Sachs, 2025

Our View

These tariffs have gone well beyond what was priced in for most regions (ex-India). There are still a few days before they come into effect, so some are questioning whether this provides a (short) window for negotiation. But at this point, that may be more hope than reality from groups that believed Trump would never go this far. More likely, we are entering a tit-for-tat escalation.

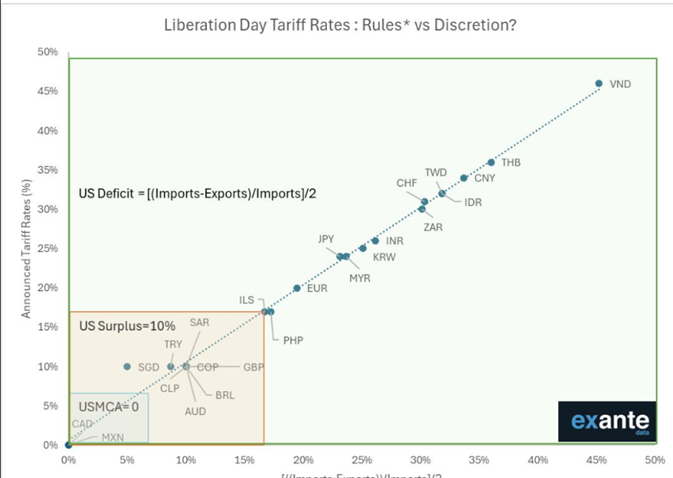

It is also interesting to note that the tariff rates set yesterday appear to be perfectly correlated with US bilateral trade deficits (chart below). This implies that the goal is simply to reduce such deficits – an election promise made by Trump. If so, it lessens the likelihood that any negotiations will be forthcoming.

Source: Exante Data

What does this mean for global markets?

Japan

Often seen as a geared play on global growth and has thus been hit quite hard as recession risks rise. Banks are particularly weak, as weaker economic conditions challenge the Bank of Japan’s (BoJ) ability to raise rates.

India

India appears to have come out “well” from yesterday’s developments, confirming the assumption that it is a safe port in a tariff storm. That has worked against it somewhat, as tariff fears have receded year-to-date, but could now act as support. No incremental adverse impact on export sectors (IT services, pharma, autos). Reciprocal tariffs at 27% are unhelpful, but India is a relative winner within Asia. The market was only off -0.3%. However, there were big internal moves – IT services (a proxy on US corporate spend) down significantly, pharma up sharply. There had been major concerns on both, but the negative US outlook is overwhelming any relief rally for IT & pharma.

Interestingly, after a period of relative weakness, the Indian market is trading well and has begun to show signs of relative strength versus China and Japan.

Latin America

Latin America is relatively insulated and sits at the low end of the tariff spectrum – all countries are at the base 10% rate, with Mexico (and Canada) continuing to benefit from USMCA exemptions. While a global recession would clearly not be helpful, the region has been supported by a weaker US Dollar, which is helping to lower domestic inflation expectations and could allow for additional rate cuts, or earlier cuts in Brazil’s case. The Mexican Peso (MXN) is up 2%, and stimulus is expected to follow once tariffs are in place, which may partly explain the region’s resilience.

Overall, Latin America should fare well on a relative basis given its greater exposure to China than to the US. If China responds with more stimulus, it could offset some of the negative tariff impact. For Mexico, attention is focused on the renegotiation of the USMCA, which is likely to begin ahead of schedule (previously set for next year). While Trump has repeatedly criticised NAFTA, he has not addressed its replacement, USMCA, which he signed during his first term. MSCI Mexico is up 2% pre-market, largely driven by peso strength, and Mexico's competitive position versus Asian exporters has improved further.

China/Asia

The 34% tariff is higher than expected, up from the 20% announced in February and March. It also includes imports from Hong Kong and Macau. Exporters are being hit as expected, but domestic names in China are largely flat today – encouraging, with the presumption being that the next leg of consumption stimulus will follow after the tariffs are in place, contributing to the resilience.

Most of the US’s Asian trading partners are facing higher-than-expected tariffs, including Vietnam (46%), Taiwan (36%), Thailand (36%), and Indonesia (32%). Sports apparel brands that manufacture in Vietnam, such as Lululemon (-10%) and Nike (-6%), are being heavily impacted.

Gold

Gold benefits from safe-haven demand and acts as a hedge against inflation. The tariffs add friction to global trade flows and will increase inflationary pressure. The weaker US Dollar also helps stimulate gold demand. Gold remains on a strong upward trajectory, and we see no reason for this to change following these announcements.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The Funds managed by the Global Equities Team:

- May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund.

- May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares.

- May have a concentrated portfolio, i.e. hold a limited number of investments or have significant sector or factor exposures. If one of these investments or sectors / factors fall in value this can have a greater impact on the Fund's value than if it held a larger number of investments across a more diversified portfolio.

- May invest in emerging markets which carries a higher risk than investment in more developed countries. This may result in higher volatility and larger drops in the value of a fund over the short term.

Certain countries have a higher risk of the imposition of financial and economic sanctions on them which may have a significant economic impact on any company operating, or based, in these countries and their ability to trade as normal. Any such sanctions may cause the value of the investments in the fund to fall significantly and may result in liquidity issues which could prevent the fund from meeting redemptions. - May invest in companies predominantly in a single country which maybe subject to greater political, social and economic risks which could result in greater volatility than investments in more broadly diversified funds.

- May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay.

- May, in certain circumstances, invest in derivatives but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

The risks detailed above are reflective of the full range of Funds managed by the Global Equities Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID."

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

Mark Hawtin

Mark Hawtin is head of the Global Equities team. Mark joined Liontrust in 2024 from GAM, where he was an Investment Director running global long-only and long/short funds investing in the disruptive growth & technology sectors. Before joining GAM in 2008 he was a partner and portfolio manager with Marshall Wace Asset Management for eight years, managing one of Europe’s largest technology, media and telecoms hedge funds.