The rise of Chinese electric vehicle (EV) manufacturing has been well documented and BYD has risen to become the brand with the world’s largest unit sales count. With a forecast 6.5 million units for 2026, this will eclipse the likes of Tesla by over three times their expected two million units. However, the success of Xiaomi points to a more interesting point – they are not an auto manufacturer by heritage but a consumer electronics maker. They are better known for household electronics like intelligent speakers, TVs, smart air fryers and mobile phones. What right do they have to be producing such successful EVs?

The rise of Chinese electric vehicle (EV) manufacturing has been well documented and BYD has risen to become the brand with the world’s largest unit sales count. With a forecast 6.5 million units for 2026, this will eclipse the likes of Tesla by over three times their expected two million units. However, the success of Xiaomi points to a more interesting point – they are not an auto manufacturer by heritage but a consumer electronics maker. They are better known for household electronics like intelligent speakers, TVs, smart air fryers and mobile phones. What right do they have to be producing such successful EVs?

The answer probably lies in the fact that in many ways an electric car with all its connectivity, advanced sensing and software puts it closer to consumer electronics than most in the car industry would like to admit. With significantly less moving mechanical parts, the mechanical engineering heritage of the traditional manufacturers is devalued. An electric car may have as little as 20 to 25 moving parts in their drivetrain. A gasoline car may have as many as 100 parts in the engine alone and well over 1,000 moving parts in total. The manufacturing skillsets are totally different and with Chinese innovation in consumer electronics, they are well set to keep producing better cars quicker and cheaper than the West.

Market forecasters expect unit sales in 2025 of about 20 million EV units globally. China will produce more than 60% of those units; BYD alone over 25%. Less mechanical engineering challenges and way fewer moving parts means better reliability, cheaper running costs and likely great longevity.

Market forecasters expect unit sales in 2025 of about 20 million EV units globally. China will produce more than 60% of those units; BYD alone over 25%. Less mechanical engineering challenges and way fewer moving parts means better reliability, cheaper running costs and likely great longevity.

It is really hard to see where the future lies for traditional auto makers even if they wholeheartedly adopt EV. According to the European Commission, there are almost 14 million people employed in the European auto industry. Manufacturing (direct and indirect) accounts for 3.5 million jobs, with sales and maintenance a further 4.5 million. The impact of EVs, combined with autonomous driving, puts many of these jobs at risk. The combination of entrenched views in Europe, a lack of labour flexibility and general intransigence make the outlook bleak for a manufacturing sector that is starting to look far more like a new strand of consumer electronics than anything else.

How can Xiaomi develop products so fast? This new model sold out 10,000 units online in just 10 minutes. Where does this kind of brand and product hype exist in the world of autos? It is surely an indicator of the consumer electronics nature of evolving autos; way less competitive than at first thought and a market that lends itself well to the classic Chinese fast follower advantages. What is even more mind-boggling is that when the car was previewed last year, the expected price point was well over $100,000; the launch price just a few months later is $75,000 – top-quality consumer electronics with costs trending down.

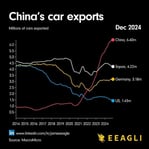

Post-Covid, the Chinese have been taking market share in foreign markets at an astonishing pace. This should perhaps not come as a surprise – there have been many technologies copied in the past and surpassed by the sheer manufacturing prowess of the Chinese. Mobile phones are a case in point. Go back to 2007, just before the iPhone was launched by Apple and Nokia had unit sales of 437 million or an almost 50% global market share. Blackberry also had meaningful penetration – 20% of the market in 2009. Neither company was able to hold on in any way. This was not just about the launch of smartphones and their competitive threat; it was far more about the ability of the incumbent players to re-engineer and develop new products rapidly and cheaply enough.

This type of competitive threat will be even more difficult for the traditional ICE auto manufacturers. A typical model cycle for the European auto makers is seven years – in today’s world that is a lifetime or, perhaps more accurately, a life sentence! Xiaomi Automobile (the auto division of Xiaomi) was formed in 2021; the company received a permit to produce vehicles in August 2022 with production of the first vehicle, the SU7, in December 2023. The consumer electronics culture is just faster and cheaper. Many in the EV industry think that EV production will be totally commoditised over a relatively short space of time.

The bulls for Western world manufacture will cite the moat around AI, FSD and robotaxis. However, DeepSeek has shown clearly that the West’s advantage in AI is not as big as was thought. The only true advantage for any ‘value add’ will come from the network effect, one of our key disruption lenses. If a small number of companies control significant portions of the autonomous fleet then they will have a data edge that will set them aside and create a significant competitive advantage. But why can’t this advantage accrue to a company that already has the platform positioning like Uber? It makes sense to us that the Western world should focus on network benefits and maybe consider, for example, a Tesla/Uber combination rather than attempt total self-world dominance. Manufacturer and brand is definitely not the answer. Oh, and look out, both BYD and Xiaomi have distinct business units, backed with billions of dollars of R&D spend, working on a humanoid robot. I wouldn’t bet against them winning this war either.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The Funds managed by the Global Equities Team:

- May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund.

- May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares.

- May have a concentrated portfolio, i.e. hold a limited number of investments or have significant sector or factor exposures. If one of these investments or sectors / factors fall in value this can have a greater impact on the Fund's value than if it held a larger number of investments across a more diversified portfolio.

- May invest in emerging markets which carries a higher risk than investment in more developed countries. This may result in higher volatility and larger drops in the value of a fund over the short term.

Certain countries have a higher risk of the imposition of financial and economic sanctions on them which may have a significant economic impact on any company operating, or based, in these countries and their ability to trade as normal. Any such sanctions may cause the value of the investments in the fund to fall significantly and may result in liquidity issues which could prevent the fund from meeting redemptions. - May invest in companies predominantly in a single country which maybe subject to greater political, social and economic risks which could result in greater volatility than investments in more broadly diversified funds.

- May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay.

- May, in certain circumstances, invest in derivatives but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

The risks detailed above are reflective of the full range of Funds managed by the Global Equities Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID."

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

Mark Hawtin

Mark Hawtin is head of the Global Equities team. Mark joined Liontrust in 2024 from GAM, where he was an Investment Director running global long-only and long/short funds investing in the disruptive growth & technology sectors. Before joining GAM in 2008 he was a partner and portfolio manager with Marshall Wace Asset Management for eight years, managing one of Europe’s largest technology, media and telecoms hedge funds.