Few countries are as pivotal to the world’s green transition as Chile. The country has vast reserves of both copper and lithium, but what truly sets it apart is not just mineral wealth, but its bold embrace of technological innovation. By integrating AI, blockchain and advanced sustainability practices, Chile is forging a new model for resource-rich countries seeking to lead the global shift towards cleaner, more transparent and more ethical supply chains.

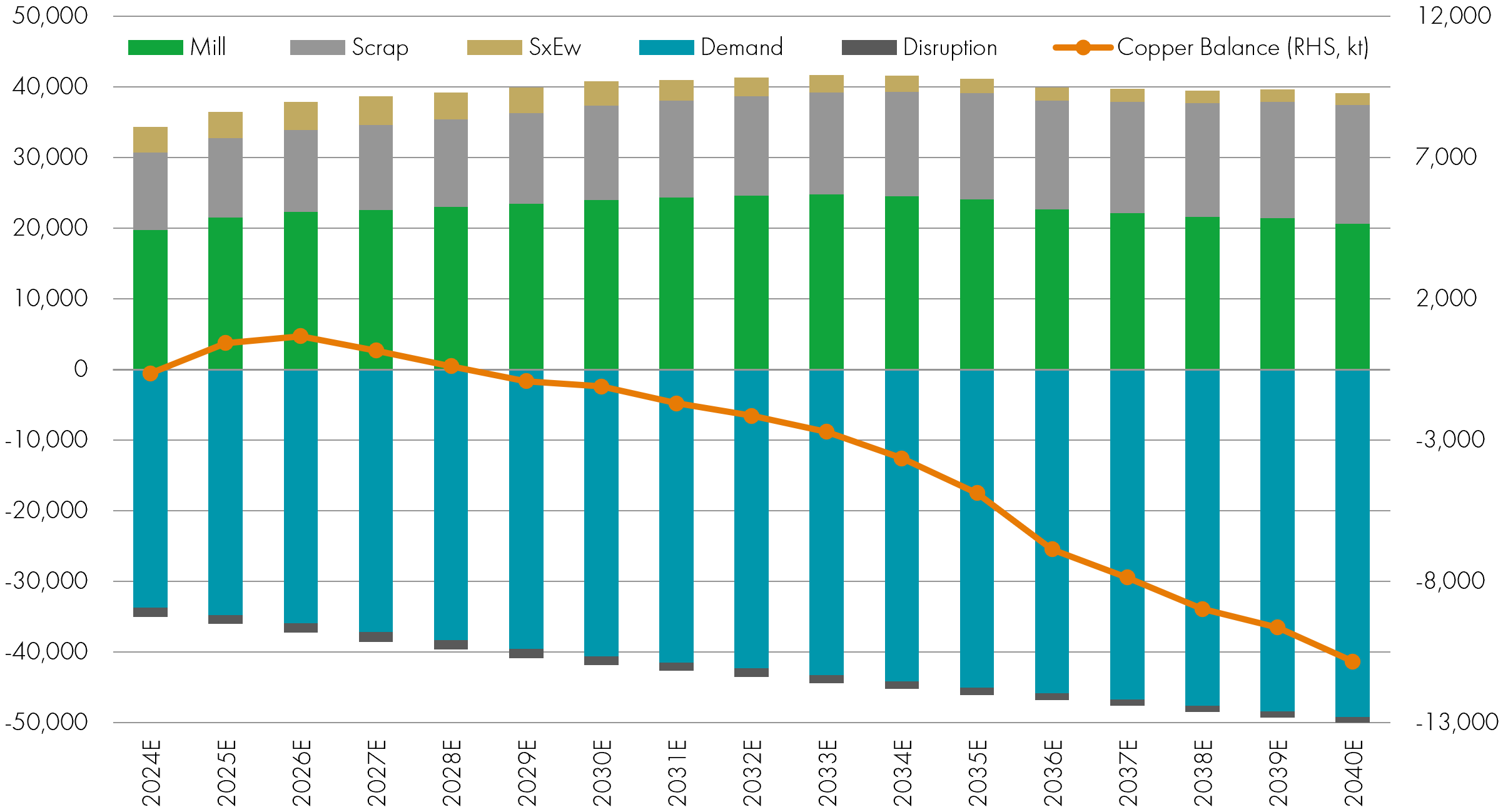

Copper and lithium, often dubbed “critical minerals”, are the backbone of the clean energy revolution. They are essential for electric vehicles, solar panels, wind turbines and the batteries that store renewable power. Chile is the world’s largest producer of copper and the second-largest supplier of lithium, accounting for roughly a quarter of global output of both metals. As demand for these minerals is projected to soar – copper by 50% and lithium by 600% by 2040 – Chile will play a key role in ensuring supply can keep up, including companies like SQM which produces 15% of lithium globally.

But Chile’s dominance is not guaranteed. Many of its largest copper deposits are aging and declining in quality, and the process of developing new mines is fraught with political, environmental and social complexities. Local opposition, regulatory hurdles and the imperative to protect fragile ecosystems are real constraints. The challenge is not just to mine more, but to mine smarter – and more sustainably.

World Copper balance breakdown (kt)

Source: WoodMac, Bernstein, December 2024

Chile’s mining sector is undergoing a quiet revolution powered by AI. AI-driven predictive maintenance systems are now commonplace, analysing sensor data to forecast equipment failures and prevent costly downtime. This has led to dramatic reductions in maintenance costs and unplanned outages at major mining operations. Unplanned downtime costs the world’s 500 largest companies nearly $1.4 trillion annually, about 11% of revenues, and predictive maintenance systems have reduced catastrophic failures in critical mining equipment, such as trucks, pumps and mills, by as much as 60%. Real-time environmental monitoring, powered by AI, is also helping companies optimise water usage and energy consumption – critical in a country where water stress is a growing concern. BHP’s Escondida mine in northern Chile has been able to reduce water and power consumption by 2-3%; with its water coming from a desalination plant in the water scarce Atacama Desert, even small reductions in water use are critical for preserving local ecosystems and reducing stress on limited resources.

Perhaps most transformative is AI’s role in resource management. By analysing geological data, AI can pinpoint high-grade ore deposits more accurately and efficiently, reducing exploration costs and environmental impact. Chilean innovators are even using AI-powered scanners to recover copper from mining waste, potentially reclaiming up to 40% of minerals that would otherwise be lost. This not only boosts productivity but also reduces the environmental footprint of mining operations.

Automation, too, is reshaping the workforce. Autonomous haul trucks and drilling equipment, guided by AI, are becoming the norm at large sites. These technologies improve safety by removing workers from hazardous environments and enable round-the-clock operations, further increasing efficiency.

As global consumers and manufacturers demand cleaner, more ethical supply chains, transparency has become a strategic imperative. Blockchain is a technology well suited to track the provenance of minerals and the sustainability of their production. Chile’s National Electricity Coordinator is piloting the Renova initiative, a blockchain platform designed to trace the renewable energy used in copper production. By logging every megawatt of renewable power that goes into mining, Renova provides verifiable proof that Chilean copper is produced with lower carbon emissions. This not only addresses the risk of “greenwashing” but also gives mining companies a competitive edge in global markets where buyers increasingly demand certified, sustainable materials.

Chile’s innovation agenda is not limited to mining. The country is aggressively phasing out coal, with a goal to retire or retrofit 70% of its coal plants by the end of 2025 – well ahead of its initial targets. The government’s National Green Hydrogen Strategy aims to make Chile the world’s lowest-cost producer of green hydrogen by 2030 and a top three global exporter by 2040. Green hydrogen, produced using renewable energy, is seen as a game-changer for decarbonising heavy industry, transportation and even mining itself.

Pilot projects are already underway, operated by Chilean steel company CAP and utility Engie Chile as well as many of the major global energy companies. Projects also include the development of Chile’s first locally made hydrogen bus. The government’s Green Hydrogen Action Plan, published in 2024, outlines steps to build the necessary infrastructure and regulatory framework to scale up production and the use of green hydrogen across sectors. The country is well positioned to be a key player in the production of green hydrogen given its abundant renewable energy resources – vast solar radiation in the Atacama Desert and consistent winds in Patagonia.

Technological disruption is only as effective as the people who drive it. Chile’s innovation story is as much about human capital as it is about hardware and software. The country is investing in STEM education, nurturing a new generation of engineers, data scientists, and entrepreneurs who can harness AI and blockchain for local challenges. Ethical considerations are also coming to the fore. As AI and automation transform the mining workforce, there are questions about job displacement, worker safety, and the role of humans in increasingly digital operations. Chilean innovators and policymakers are actively engaging in these debates, seeking to ensure that technology serves both economic and social goals.

Chile’s unique combination of mineral wealth, technological ambition and commitment to sustainability positions it as a bellwether for the global green transition. By leveraging AI to optimise mining, blockchain to ensure transparency and green hydrogen to decarbonise industry, Chile is not just adapting to disruption – it is actively shaping the future of energy and resource management.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The Funds managed by the Global Equities Team:

- May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund.

- May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares.

- May have a concentrated portfolio, i.e. hold a limited number of investments or have significant sector or factor exposures. If one of these investments or sectors / factors fall in value this can have a greater impact on the Fund's value than if it held a larger number of investments across a more diversified portfolio.

- May invest in emerging markets which carries a higher risk than investment in more developed countries. This may result in higher volatility and larger drops in the value of a fund over the short term.

Certain countries have a higher risk of the imposition of financial and economic sanctions on them which may have a significant economic impact on any company operating, or based, in these countries and their ability to trade as normal. Any such sanctions may cause the value of the investments in the fund to fall significantly and may result in liquidity issues which could prevent the fund from meeting redemptions. - May invest in companies predominantly in a single country which maybe subject to greater political, social and economic risks which could result in greater volatility than investments in more broadly diversified funds.

- May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay.

- May, in certain circumstances, invest in derivatives but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

The risks detailed above are reflective of the full range of Funds managed by the Global Equities Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID."

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

Thomas Smith

Thomas Smith is a fund manager, having joined Liontrust as part of the acquisition of Neptune Investment Management in October 2019. He has a Master’s degree in Chemistry from Oxford University and is a CFA Charterholder.